Income tax obligations frequently be a complex and often challenging aspect of personal finance. It is crucial to have a clear comprehension of your taxable responsibilities to avoid penalties and ensure accurate filing.

Firstly, it is important to determine your earnings. This includes wages, salaries, capital income, and any other types of payment. Once you have listed all income sources, you can then calculate your total earnings.

,Following this, you will need to become aware yourself with the income tiers that apply to your position. These schedules outline the percentage of your income that will be levied based on your income level.

Finally, it is highly suggested to consult a qualified tax advisor. They can offer personalized guidance based on your unique fiscal circumstances and help you in fulfilling your income tax obligations accurately and effectively.

Maximize Your Tax Refund

When tax season arrives, it's crucial to guarantee you're getting every dollar you're entitled to. Maximizing your tax refund can offer valuable funds for future expenses or even prompt debt reduction. To achieve this, consider taking advantage of available tax deductions.

- Research potential credits and deductions that pertain to your individual profile

- Organize all relevant documents to ensure a smooth submission

- Speak with a qualified tax advisor for personalized suggestions

Common Deductions and Credits

When filing your taxes, you may be eligible for various deductions that can minimize your tax liability. Usual deductions allow you to reduce certain costs from your total revenue. Some popular deductions include donations, doctor bills, and SALT|property taxes. On the other hand, credits directly reduce your tax obligation dollar for every amount. Examples of frequent credits include the child tax credit, the lifetime learning credit, and the worker credit. Consulting a tax professional can help you identify all applicable deductions and credits to optimize your tax filing.

Smart Tax Planning

Successfully navigating the complexities of tax filing can feel overwhelming, though with the right strategies, you can decrease your tax liability click here and maximize your return. One effective strategy is to maximize all eligible deductions. Carefully examine your income and expenses throughout the year to identify potential deductions for things like education. Moreover, consider implementing tax-advantaged accounts, such as 401(k)s and IRAs, to reduce your taxable income. Lastly, it's crucial to speak with a qualified tax professional who can provide personalized advice based on your unique financial situation.

Understanding Self-Employment Tax Obligations

Embarking on a self-employed journey offers freedom, but it also brings the responsibility of managing your own financial obligations. Self-employment taxes, encompassing both Social Security and Medicare deductions, can seem complicated at first. To effectively manage this aspect of self-employment, it's essential to educate yourself with the guidelines.

- Research the applicable tax laws and schedules required for self-employed individuals.

- Set aside a portion of your income regularly to cover your estimated self-employment tax burden.

- Collaborate with a qualified tax professional to optimize your tax strategy.

Influence of Tax Policy on Your Finances

Tax policy plays a crucial role in shaping your financial well-being. Understanding the intricacies of tax laws and regulations can empower you to make savvy financial decisions. When formulating your budget, it's essential to factor in the potential impact of various tax rates on your revenue. Moreover, regulations governing deductions and credits can significantly reduce your tax liability. By remaining abreast of changes in tax policy, you can optimize your financial circumstances and realize your economic goals.

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Shannon Elizabeth Then & Now!

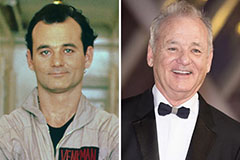

Shannon Elizabeth Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!